UPDATE: If you don’t qualify for the 50,000-mile offer described below, check your local Chase branch.

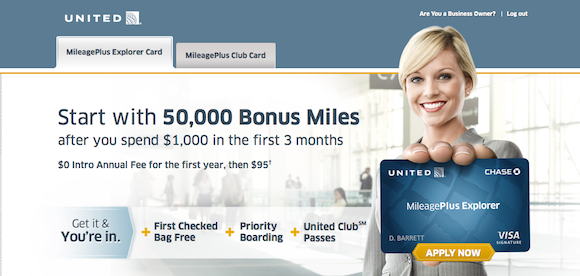

The standard signup bonus for the United MileagePlus Explorer card is 30,000 miles after spending $1,000 within three months, but targeted offers touting higher signup bonuses for the card surface frequently.

The standard signup bonus for the United MileagePlus Explorer card is 30,000 miles after spending $1,000 within three months, but targeted offers touting higher signup bonuses for the card surface frequently.

I recently received what appeared to be a targeted offer for 50,000 miles – with the same spending requirement – in the mail. Unlike a typical targeted offer, however, the mailing did not contain an offer code or any other type of personalized information; rather, it simply directed me to “Apply at UnitedExplorerCard.com/50KStart by June 15, 2013.” I had already capitalized on a targeted 50,000-mile offer for the MileagePlus Explorer card last year, but I was curious to see if the offer was available to anyone who simply entered the “50KStart” URL.

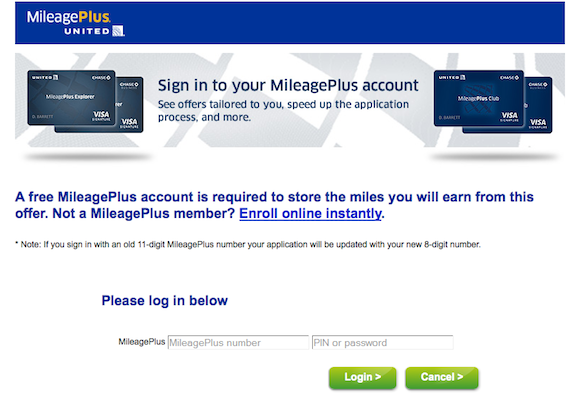

The answer, it turns out, is not necessarily — but the link does provide a quick and easy way to determine whether you qualify for the offer. When you enter the URL, you are prompted to either log in to your MileagePlus account or enroll in the program.

If you do not yet have a MileagePlus account but enroll in the program to explore this offer, I’d be very curious to know whether the 50,000-mile bonus is extended to you. Please post your result in the comments!

I plugged in my MileagePlus number and password, and was informed that I am eligible – again – for the offer.

I won’t apply for the card because I already have a Chase-heavy wallet and want to let my credit profile with Chase cool down a bit before applying for another card – especially a card that I recently churned. But I love 50,000-mile bonuses, and the MileagePlus Explorer card offers a very useful checked-bag perk and two lounge passes to boot, so it’s certainly a tempting offer. If you’re interested in the card, you might as well enter your MileagePlus number and see if you’re offered the 50,000-mile bonus. Keep in mind, however, that many other cards are superior to the MileagePlus card for actual spending, so if you don’t already have a good lineup of quality cards that earn cash or flexible points on a dollar-by-dollar basis, I’d suggest focusing on that front and worrying about signup bonuses down the road.

Pingback: Bits ‘n Pieces for May 8, 2013 - View from the Wing()

Pingback: United Club Card -- First Year Free? - We Fly Free()

Pingback: Affiliate Hall of Shame: Blog Posts that Pump an Affiliate When a Better Offer Exists - Page 2 - FlyerTalk Forums()