A few months ago, I set forth my case for using Ally Bank as my primary checking account. And while I plan to stick with Ally as my primary checking account for its consumer-friendly features like unlimited ATM-fee reimbursements, free checks, and mobile deposit, I’m considering moving most of my liquid assets to BankDirect (an “internet division” of Texas Capital Bank) and its “Mileage Checking with Interest” account.

The account yields an impressive rate of interest in the form of miles: 100 American AAdvantage miles per month for every $1,000 of average daily balance on deposit, up to $50,000. For every $1,000 in excess of $50,000, the account yields only 25 miles per month.

Notwithstanding the “Mileage Checking with Interest” moniker, there is no meaningful “Interest” component aside from the “Mileage.” In fact, the annual interest rate on the account tops out at one one-hundredth of one percent!

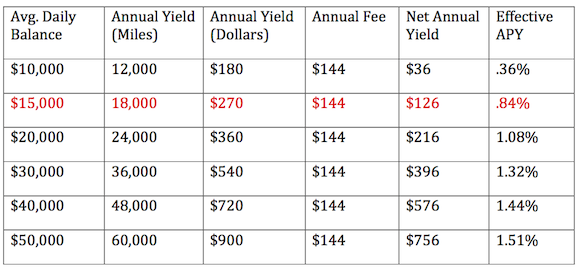

To help compare the Mileage Checking account to other checking products, we can convert its mileage yield to an approximate interest rate and account for its $12 monthly fee.

Each $1,000 on deposit (for the first $50,000) generates 1,200 miles per year, so each dollar yields 1.2 miles annually. If you accept the proposition that American AAdvantage miles are worth about 1.5 cents apiece, an annual yield of 1.2 miles equates to a cash yield of about 1.8 cents, or a 1.8% APY. That 1.8% APY, however, is mitigated by a non-waivable $12 monthly fee on the account. The chart below shows the effective APY for various account balances up to $50,000, taking the $12 monthly fee into account.

As you can see, the Mileage Checking account offers some very enticing yields for large balances in today’s ultra-low interest environment. I highlighted the $15,000 row in red because $15,000 is the turning point above which I’d start to be better off using a BankDirect Mileage Checking account than an Ally checking and savings account in combination, as outlined here. BankDirect also offers four ATM-fee reimbursements per month (capped at $2.50 per transaction) on the account, and 10,000 bonus miles if you enroll in direct deposit.

I should note, however, that BankDirect does not offer mobile deposit functionality (or even a mobile app for that matter), so if you use BankDirect as your primary checking account you’d have to mail any checks you receive to a central processing center. That’s pretty inconvenient, though I do appreciate the irony of highlighting “the convenience of online banking” as one of the major selling points of the account:

*At the time of posting, the maximum average daily balance eligible to earn 100 miles per month is $200,000, but as of June 1, 2013, the maximum will decrease to $50,000.