Warning: As of March 24, 2013, some of the information contained in this post is outdated, so please read this post for more current information!

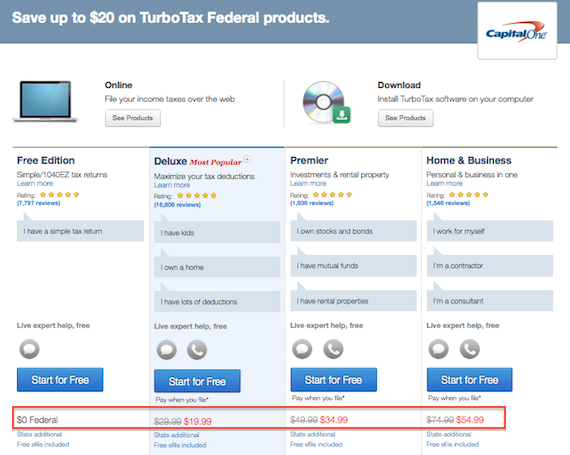

I have used TurboTax for years, and have no problem whatsoever with the quality of the product, but its pricing schemes are less transparent than a papal election. To illustrate my point, let’s start by observing that the TurboTax website offers the following prices:

- Federal Free Edition: free federal, state additional

- Deluxe: $19.99 federal, state additional

- Premier: $34.99 federal, state additional

- Home & Business: $54.99 federal, state additional

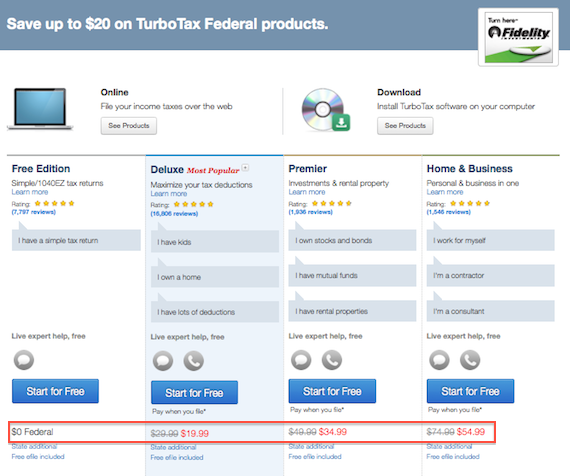

Next, consider the fact that many financial institutions purport to offer special discounted rates to their customers, but those rates are often no better than the rack listed on the TurboTax website.* For example, take a look at the allegedly discounted rates offered by Capital One and Fidelity:

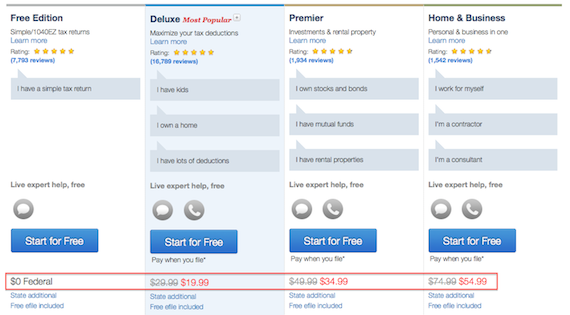

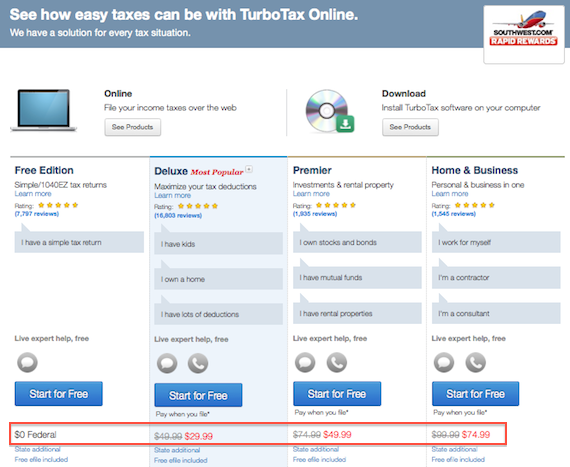

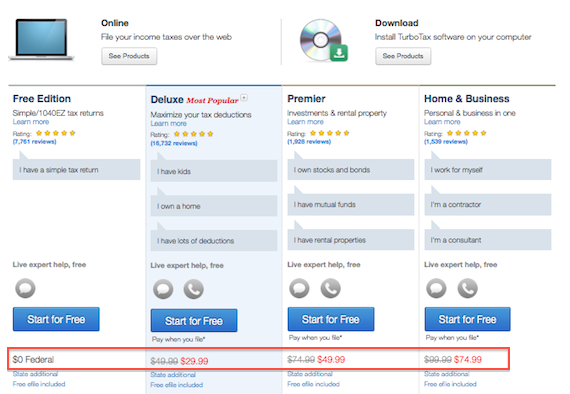

But here’s the real kicker. If you access TurboTax through an online shopping portal, the package prices that you’ll be presented with are significantly higher than the package prices listed on the TurboTax website. And if that wasn’t sinister enough, the crossed-out prices masquerading as “regular” prices are markedly higher than the “regular” prices presented to consumers who access the TurboTax website directly; simulating the same magnitude of “savings” for shopping-portal customers as direct customers. Take a close look at the screenshots below: the top image depicts the prices offered to consumers who access the TurboTax site directly, and the bottom two images display the prices for consumers who access the TurboTax site through two of the strongest shopping portal deals: TopCashBacks’s 16% cash rebate and Southwest Airline’s fixed 1,000-mile rebate.

Pretty remarkable.

But before you forsake online shopping portals entirely (for TurboTax only, I hope, as this discriminatory pricing scheme is a true aberration), I should note that there’s a credible argument to be made that a “Deluxe” customer may be better off paying the extra $10 and netting 1,000 Southwest miles (which are worth up to 1.66 cents each). I wouldn’t do it, but I might if I flew Southwest more often. Sadly, however, the higher prices presented to shopping-portal customers always outweighs the 16% TopCashBack rebate, and all other pro-rata rebates that are currently available through online shopping portals.

The bottom line? The normal rules of intelligent consumerism are suspended in the world of tax software. No need to shop around; the price is always the same. Do not assume familiarity with the terms “discount” or “save.” And if you waste your time trying to earn points through online shopping portals, you’ll end up wasting your money as well.

*After exhaustive research, I did find one legitimate discount on TurboTax services: Vanguard’s “Flagship” (top-tier) members are eligible for significantly discounted prices (e.g., $9.99 for the TurboTax Premium package). If you are a top-tier client of any financial institution, it’s worth investigating whether they offer comparable packages.