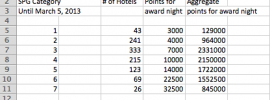

Starwood’s annual category “adjustments” were released today and, as usual, more properties moved up a category (i.e., became more expensive) than down a category (became less expensive). The new categories become effective on March 5, so you can … [Continue reading]