Starwood’s annual category “adjustments” were released today and, as usual, more properties moved up a category (i.e., became more expensive) than down a category (became less expensive). The new categories become effective on March 5, so you can make reservations at the current, pre-inflation rates until that date.

The headline numbers of today’s announcement seem grim: approximately 20% of Starwood’s portfolio (218 properties) are set to become more expensive, and less than 5% of the portfolio (48 properties) will become less expensive.

Not good.

But not as bad as it seems, either. One might initially assume – as I did – that today’s adjustments amounted to something in the vicinity of a 15% devaluation of Starpoints: a 20% price hike partially offset by a 5% price reduction. But those are the types of snap-conclusions that kept me out of the really good schools. And while there are many valid ways to quantify the impact of today’s announcements, that’s not one of them. The metric I’m really interested in is: how much less valuable will my Starpoints be on March 5th than they are today?

I think I’ve found the answer to that question, but it comes with a couple of disclaimers:

- First, I am only considering the impact of today’s announcement on the value of Starpoints when redeemed for award nights at Starwood properties. Obviously, nothing has changed with respect to the value of Starpoints when they are converted to frequent flyer programs, or put to any other use.

- The amount of points required for award nights in categories 5, 6, and 7 depends on whether the room is booked during peak or off-peak season. To make the math workable, I have assumed that the number of points required for an award night in each of these categories is the midway point between peak and off-peak redemption. So, for example, category 5 ranges from 12,000 points in non-peak season to 16,000 points in peak season, but, for the purpose of my analysis, category 5 is assumed to require 14,000 points regardless of season.

So with that in mind, here’s what I did:

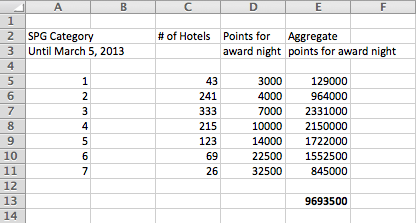

Step 1: First, I tried to calculate how many points it would take to book a single night at every Starwood on the planet (in the aggregate) “pre-adjustment”; that is, before today’s announced changes take effect. I added up the number of properties in each category as of today, and then multiplied each sum by the number of points required to redeem one award night in the applicable category.

As you can see, the grand total, pre-adjustment, is 9,693,500 points.

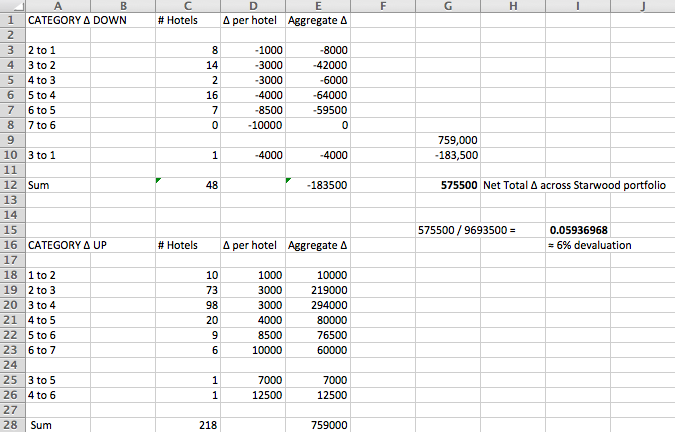

Step 2: Next, I calculated the net change in the number of points that would be required to book a single night at every Starwood on the planet after today’s announced changes take effect. I tallied all of the category changes, and then multiplied each type of change by the appropriate difference between the points required for redemption pre-adjustment and post-adjustment. The 48 downward adjustments result in a decrease of 183,500 points, and the 218 upward adjustments result in an increase of 759,000 points, for a net increase of 575,500 points.

Step 3: Dividing the total change triggered by the adjustment by the pre-adjustment grand total from Step 1 should yield the weighted average of the change in the value each Starpoint. So if my logic holds, today’s announcement amounts to a 6% Starpoint devaluation (see right-hand side of figure above).

Six percent is a significant devaluation, and, as a Starwood loyalist, it stings. But I’d imagine (I haven’t run the numbers yet) that it isn’t on the same order of magnitude as the recent Hilton or Marriott devaluations.

Do you agree? Disagree? Are there holes in my math? Please comment.