Last Thursday, I had breakfast with Matthew Goldman, the CEO of Wallaby Financial. Wallaby is a promising start-up company with two related products: the Wallaby mobile app, which identifies the most rewarding credit card in your wallet for a given purchase, and the Wallaby card, which, once released, will link to your other credit cards and automatically route a transaction through your most rewarding card at the point of purchase.

The Wallaby App

The Wallaby app was launched last November. Setup is simple: just identify the types credit cards you own (no personal information required) so that Wallaby knows what type of plastic you’re working with. The app then uses GPS to detect where you are (i.e., in a Best Buy, Starbucks, etc.) and which of your credit cards will provide the best return on a purchase within that store.

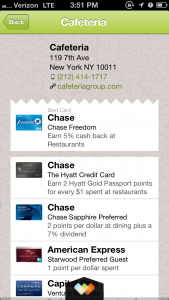

I met Matthew at a restaurant called Cafeteria, and here’s what Wallaby recommended to optimize rewards at Cafeteria:

I generally agree with Wallaby’s recommendations, but see how Hyatt points are considered to be more valuable that Chase Ultimate Rewards (“UR”) points? That’s what actually led to our meeting. I had been playing around with the app a few months ago, and noticed that Hyatt points were valued higher than UR points. I disagreed with that valuation, because UR points can be converted instantly to Hyatt points on a 1-to-1 basis, so they are necessarily – in my mind – at least as valuable as Hyatt points. Plus, UR points are much more flexible: they can be converted instantly into United miles, BA avios, and several other points currencies (see here).

So I strictly prefer UR points to Hyatt points, and sent some feedback to Wallaby making my case. Matthew actually responded to my email, and set forth his rationale for placing a higher value on Hyatt points than UR points. I’m paraphrasing, but the gist of Wallaby’s valuation is that Hyatt points are one of, if not the, best redemption options for UR points. (I take no issue with this statement.) Wallaby is well-aware that UR points can be converted into Hyatt points, but notes that UR points can also be redeemed in a variety of less optimal ways, and that the average consumer will realize less value from UR points than from Hyatt points.

It’s a fair point, which raises the following question: Should the value of a point be determined by reference to the value that a discerning cardholder would achieve by redeeming that point intelligently, or by reference to the value that an undiscerning cardholder would achieve by redeeming that point haphazardly? I prefer the former approach, as the latter effectively treats flexibility as a detriment rather than an attribute.

But reasonable minds can certainly differ, and what’s great about version 2.0 of the Wallaby app (released last week for Androids, coming soon for iPhones) is that it allows users to change the default value placed on each type of point and mile in accordance with their personal preferences. So a user like me will be able to increase the value that Wallaby assigns to UR points, and the order of preference that Wallaby returns will reflect that new value. As far as I’m concerned, this is the best way for Wallaby to tackle the complex problem of valuing points and miles: provide reasonable default values for beginner users and permit advanced users to modify those default values.

The Wallaby card is similar to the Wallaby app in that it helps users select the optimal credit card to use at a given retailer, but it streamlines the process even further by automatically selecting a credit card and initiating the transaction in a single swipe. No need to take out your phone and call up the Wallaby app’s recommendations, or even carry the recommended card in your wallet – the Wallaby card, if successfully implemented, will automate the entire process at the point of purchase and obviate the need to carry multiple credit cards.

Like the Wallaby app, the Wallaby card will suggest reasonable default values for the various types of points and miles, but users will be able to change those values based upon their own preferences. The Wallaby card will be fee-free for the first six months, and then carry a $50 annual fee. I’m not deterred by the $50 annual fee; aside from the sheer convenience of carrying a single card, the Wallaby card will eliminate the point-forfeiting mistakes that everyone makes, like forgetting about a rotating bonus category on the Chase Freedom card. Presumably, the Wallaby card will also automatically and accurately detect merchant categories, which will eliminate the guesswork in determining whether a particular merchant falls within a vaguely-defined bonus category like “dining” or “travel.”

I’ve signed up to beta test the Wallaby card; if you’d like to be added to the beta-testing waitlist as well, you can sign up here. In the meantime, the Wallaby app is available (and free) in the iPhone and Android app stores.