I’m a bit of a coffee fiend, so I was pretty pleased to see that the bonus categories for the Chase Freedom card this quarter are gas stations, drug stores, and Starbucks. As I conceded in my review of the Freedom card, there does seem to be something unholy about the fact that “Starbucks” is on par with “gas stations” and “drug stores” these days, but my social commentary notwithstanding, this is a great category for me. First of all – and I’m not proud of this – I probably spend $20-$30 at Starbucks each week anyways. Second, it’s much easier and less cumbersome to frontload purchases at Starbucks than at other retailers, because at Starbucks you can simply load money into your account and spend from that account with a single Starbucks card (or your phone) – as opposed to buying several gift cards, keeping track of the balances on those cards, and running the risk of losing the cards.

By way of background, the Freedom card awards 5% cash back on up to $1,500 of bonused purchases per quarter, but those 5 cents per dollar can be instantly converted to five points per dollar if you also carry one of several “Ultimate Rewards” cards. I value Ultimate Rewards points at two cents apiece, so this conversion essentially doubles the value of my Freedom points. Plus, if you have a Chase checking account, you can earn another ten points per purchase (no matter how small the purchase) and an additional 10% bonus on the points you earn each month through the Chase Exclusives program.

Note: I do not recommend Chase checking accounts as a general matter; I much prefer Ally Bank checking accounts, as discussed here. I set up a Chase checking account to capitalize on the Exclusives program, but please note that you must park $1,500 in the account to avoid monthly fees.

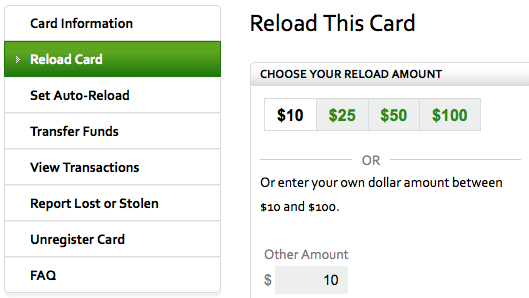

I hate to leave points on the table, so I plan to take full advantage of this quarter’s bonus by loading my Starbucks account in $10 increments until I hit the $1,500 cap on bonused purchases. Why $10 increments? Because my rate of return is maximized by spreading my spend across as many transactions as possible – given that I earn a 10 point per transaction bonus through the Exclusives program – and $10 the smallest reload amount that Starbucks permits.

Here’s how the math works out. For each $10 reload, I earn:

- 50 points ($10 x 5 points/dollar on bonused categories)

- 10 points (per-transaction bonus through the Exclusives program)

- 6 points (10% bonus on the 60 points above through the Exclusives program)

So that’s 66 points on each $10 purchase, or 6.6 points per dollar spent. At two cents per point, that’s a 13.2% kickback.

And that doesn’t even take into account the kickback from using the Starbucks gold card, which awards a free item (drink or food) for each 12 transactions on the card, which effectively yields another 8.33% discount if each transaction is limited to one item. To take a simple example, if I buy 12 iced coffees at $3 each for a total spend of $36, and I redeem the resulting free-item award for another $3 iced coffee, I’ve “earned” $3 on $36 of spend, or 8.33%. In reality, I’m not this disciplined: I’ll buy two or three items in one transaction, even though I know I’m only getting one credit instead of the two or three I’d receive if I asked the cashier to ring up each item separately. I suppose we all have our limits, and I’m not yet willing to announce my frugality to my baristas (though the internet apparently doesn’t bother me?).

So that’s my strategy. I know it seems crazy to load $1,500 onto a Starbucks card, but I know I’ll use it, and I’ll earn a whopping 9,900 points by doing so — 7,500 points for maxing out the quarterly bonus, 1,500 points for spreading my spend across 150 ten-dollar transactions (Exclusives program), and 900 points attributable to the 10% bonus on all points earned (Exclusives program). My only concern is that Chase becomes alarmed by my pattern of seemingly irrational purchases, but I figure that the worst that could happen is that they’ll deactivate my account temporarily and then reactivate it after a short phone call. I can’t imagine that these purchases would warrant any more of a crackdown than that, but I’ll be sure to report if that assumption proves incorrect!

Pingback: Points on the Dollar - A New Approach To Avoid Falling Victim To Airport Currency-Exchange Fees()